Loan Accessibility and Alternatives for Individuals with Thin Credit Files

Let’s be honest—the financial world loves a thick, detailed credit report. It’s like a well-worn passport, stamped with proof of your journey through car loans, credit cards, and mortgages. But what if your passport is nearly blank? What if you’re new to credit, or you’ve simply avoided debt like the plague? You have what’s called a thin credit file. And trying to get a traditional loan can feel like asking for a library card without any ID.

Here’s the deal: a thin file isn’t the same as bad credit. It’s an absence of data, not a record of missteps. Lenders look at it and shrug—they just don’t have enough information to say “yes” with confidence. But that doesn’t mean you’re out of options. Far from it. This guide will walk you through the real-world alternatives and strategies to build access, one step at a time.

Why a Thin Credit File Slams Doors Shut

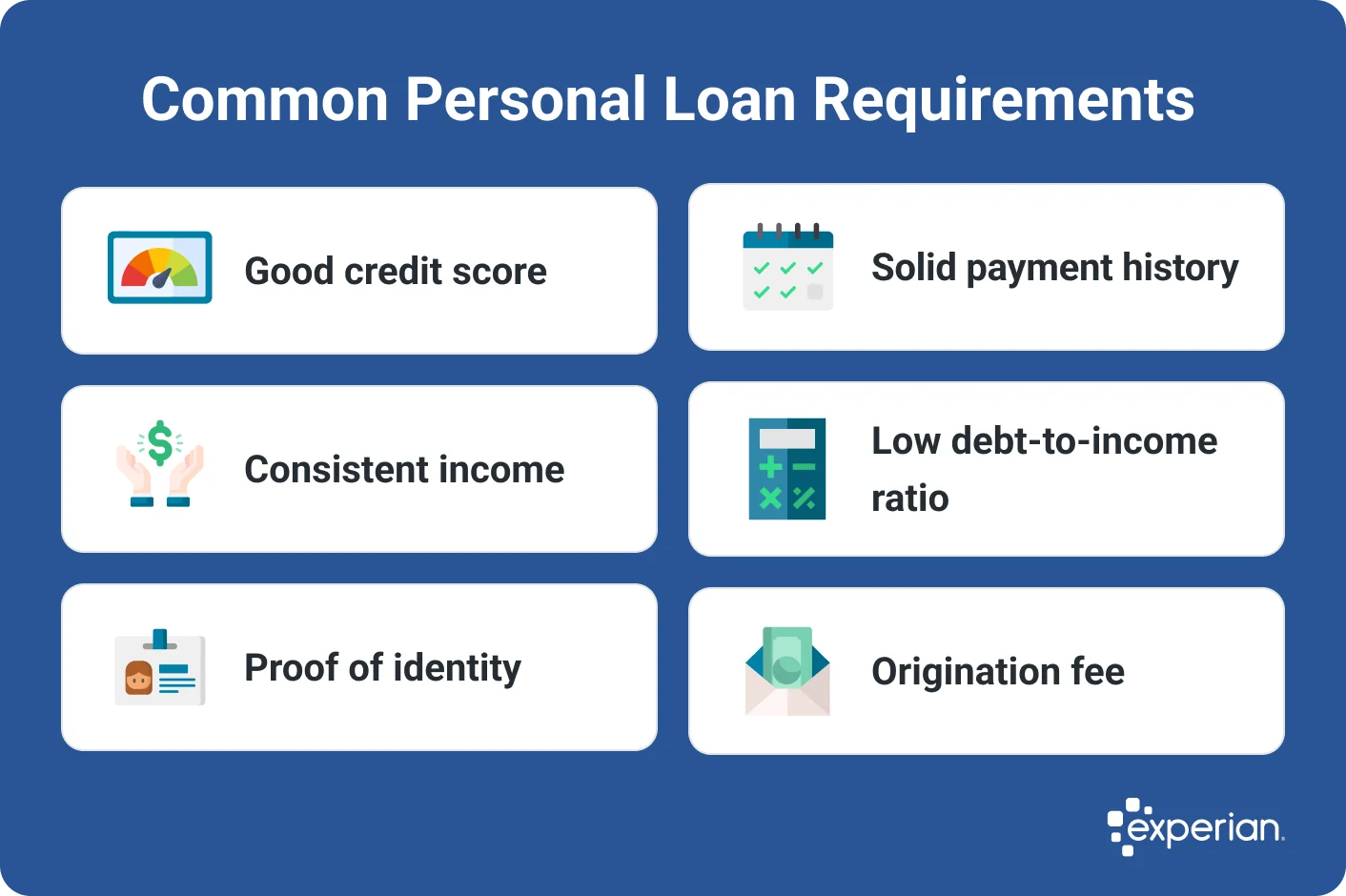

First, understanding the “why” helps. Most scoring models, especially the ubiquitous FICO score, need at least one account open for six months or more, and at least one account that has been reported to the bureaus within the last six months. Fall short of that, and you’re essentially invisible. The algorithm has nothing to chew on.

It’s a classic catch-22. You need credit to build credit, but you can’t get credit to… well, you know. This is a massive pain point for young adults, recent immigrants, or those who’ve used only cash or debit for years. The system isn’t built for you. Yet.

The Usual Suspects: Where Traditional Lenders Get Skittish

Big banks, major online lenders, credit unions—they often rely heavily on automated systems. These systems are risk-averse by design. Without a robust credit history, your application might be automatically flagged or denied. It’s not personal; it’s algorithmic. That said, some credit unions, known for their community focus, might be more willing to have an actual human look at your application. It’s worth a shot.

Practical Alternatives When You Need Funds Now

Okay, so the big players say no. What next? Don’t panic. Several paths remain open, each with its own pros and cons. Think of them as financial side streets—less crowded, but they’ll still get you where you need to go.

1. Credit-Builder Loans: The Training Wheels Approach

This is arguably the best tool for your situation. How it works is almost backwards. You don’t get the money upfront. Instead, the lender places a small loan amount (say, $500 to $1,000) into a locked savings account. You make fixed monthly payments over 6 to 24 months. Those payments are reported to the credit bureaus. Once you’ve paid the loan off, you get the money—plus any interest it earned. You essentially pay a small fee to build a positive payment history. It’s a structured, safe way to create data from nothing.

2. Secured Credit Cards: Your Entry Ticket

You provide a cash deposit as collateral—that’s your credit limit. Use it sparingly, pay the balance in full every single month, and the issuer reports your good behavior. After 8-12 months of this, many issuers will “graduate” you to an unsecured card and return your deposit. It’s a powerful, direct method to fatten up that thin credit file.

3. Becoming an Authorized User: The Piggyback Strategy

Got a family member or spouse with a strong credit card history? Ask if they’ll add you as an authorized user. Their account’s positive history can appear on your report, giving you an instant boost. Crucial note: This only works if the primary holder uses the card responsibly. Any missteps hurt you both. It requires a lot of trust.

4. Alternative Data and Fintech Lenders

This is where things get interesting. A new wave of lenders looks beyond the traditional report. They might consider your banking history—your income, cash flow, rent payments, even utility bills. Services like Experian Boost let you add phone and utility payments to your Experian report directly. Lenders like Upstart or Oportun use AI to analyze non-traditional data points. It’s not a guaranteed approval, but it’s a growing trend that benefits the thin-file crowd.

5. Peer-to-Peer (P2P) Lending Platforms

Platforms like LendingClub or Prosper connect borrowers with individual investors. You create a profile, often telling your story—which can help explain your thin file. Individual investors might be more willing to take a calculated risk on you than a faceless bank. Rates can be higher, but they’re often more accessible.

A Quick Comparison: Your Thin-File Options

| Option | How It Works | Best For | Key Consideration |

| Credit-Builder Loan | You pay into a locked account; get funds at the end. | Building history from zero; disciplined savers. | You don’t get money immediately. |

| Secured Credit Card | Cash deposit secures your credit limit. | Establishing revolving credit; daily use. | Requires upfront deposit; low limits. |

| Authorized User Status | Piggyback on someone else’s good card history. | Quick, passive history boost. | Total dependency on the primary user’s habits. |

| Fintech/Alt-Data Lender | Uses bank data, rent payments, etc., to assess you. | Those with strong income but little credit. | Newer model; rates and terms vary widely. |

The Long Game: Building a Robust Credit Profile

While the alternatives above solve immediate access, the real goal is to graduate from them. Think of it as building a house. You need a solid foundation first.

- Start incredibly small. One secured card or credit-builder loan is enough. Don’t apply for five things at once—those hard inquiries hurt.

- Payment history is king. Set up autopay for the minimum payment at the absolute least. One late payment can devastate a young file.

- Keep balances laughably low. Even with a $500 limit, try to use less than $50 a month. This “credit utilization” ratio is a huge factor.

- Let time do its work. The average age of your accounts matters. Open your first account and keep it open, forever. Patience isn’t just a virtue here; it’s a strategy.

Honestly, the process is more about consistency than complexity. It’s showing up, month after month, with tiny, responsible actions.

A Final Thought: Redefining “Creditworthy”

Having a thin credit file can feel like you’re being penalized for living responsibly within your means. It’s a frustrating paradox. But the landscape is slowly shifting. The rise of alternative data is a quiet acknowledgment that the old system leaves too many people out in the cold.

Your financial story is more than a three-digit number generated from a sparse report. It’s in your steady job, your on-time rent, the consistent balance in your checking account. The trick is to find the avenues—whether a credit-builder loan, a savvy fintech lender, or a secured card—that let you translate that real-world reliability into a language the system finally understands. Start there. The rest, as they say, will build itself.